All new Indian businesses that intend to sell goods or services are bound to follow government regulations. One such regulation is GST registration. GST registration in India facilitates your business to lawfully impose tax and grant input tax credit. It also helps build trust with your customers.

This blog will take you through every step of the process, informing you what you will need, who needs to submit, and how to apply online for a new business GST application.

Table of Contents

What is the GST Registration ?

GST registration is the online application for obtaining a GSTIN, a 15-digit code issued by the government. After you receive the GSTIN, you can charge GST on your sales and offset tax on your purchases. You also need it to file the returns and comply with other taxation norms.

For many small and medium businesses, it is a required step to begin official trade. Getting a GSTIN shows that you are a registered taxpayer and helps you deal with clients, vendors, and banks.

If you find the steps confusing or face technical challenges, using professional GST Registration services will be helpful to save time and prevent rejection.

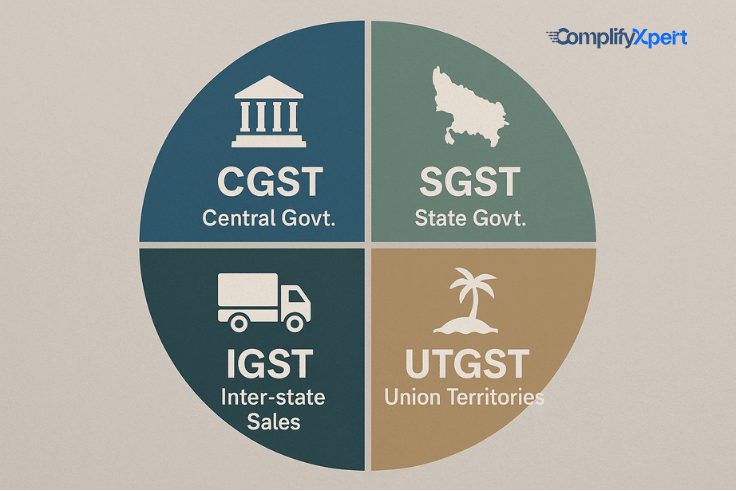

Types of GST

GST in India is categorized into four types, based on where the sale happens:

- CGST (Central Goods and Services Tax) is the tax collected by the central government for sales that happen within the same state.

- SGST (State Goods and Services Tax) is collected by the state government for sales happening within that state.

- IGST (Integrated Goods and Services Tax) is used for sales between two states. IGST is charged by the central government and passed on to the state where the consumption of the goods takes place.

- UTGST (Union Territory Goods and Services Tax) applies to sales made in union territories like Chandigarh, Lakshadweep, or Andaman and Nicobar Islands.

If you sell something in your state, both CGST and SGST will apply. If you sell to another state, IGST applies.

What are the Eligibility Criteria for GST Registration ?

Any business must apply for GST registration if its total turnover crosses certain limits. These limits vary by the type of business and the location:

- For goods suppliers: ₹40 lakh in a year

- For service providers: ₹20 lakh in a year

Other cases where GST registration is needed if turnover is low:

- You sell goods or services outside your own state

- You are selling through e-commerce platforms like Amazon

- You act as an input service distributor

- You are a casual or a non-resident taxable person

- You are liable under the reverse charge mechanism

Meeting any of the above conditions means any business is required to register for GST. So, let’s see who needs GST registration.

Who Needs to Register ?

If you are starting a business, you must register for GST in these cases:

- Your turnover goes beyond the legal threshold mentioned above

- You plan to sell products or services to another state

- You want to sell online using platforms like Amazon, Flipkart, or your website

- You are opening a service center, warehouse, or branch in another state

- You want to take part in government tenders or projects

If your business meets any of these conditions, you fall under the group that needs GST registration. Registering early can help you avoid fines and stay in line with the law. It is also important for GST registration for startups, as early registration avoids legal trouble later.

List of Necessary Documents

For online application, please ensure to have these documents for GST registration handy:

| Business Type | Documents Required |

| For individuals or sole proprietors |

PAN card of the business owner Aadhaar card Photo of the applicant Bank account details Proof of business address (like electricity bill, rental agreement, or NOC) |

| For partnerships or LLPs |

Partnership deed or LLP agreement PAN and Aadhaar of partners Photo of authorized signatories Business address proof Bank details |

| For Private Limited Companies |

Certificate of incorporation PAN of the company PAN and Aadhaar of directors Resolution authorizing a director Proof of office address |

Having these documents helps avoid delays in your GSTIN application.

GST Registration Online Process Step-by-Step Guide

1. Visit the GST portal and click on the Services tab. Choose Registration and then select New Registration.

2. Fill Part A of the Form

In this part, you need to provide:

- Business name (as per PAN)

- PAN number

- Mobile number and email for OTP verification

After OTP verification, you will receive a Temporary Reference Number (TRN)

3. Fill Part B of the Form

Use TRN to log in and complete the full application. Here, enter:

- Business type and structure

- Additional places of business

- Details of goods or services you offer

- Details of the person applying

- Bank account details

4. Submit through DSC (Digital Signature Certificate) or e-Signature.

5. A GST officer checks the form and documents. If everything is okay, you will get your GSTIN within 3 to 7 working days.

If there are issues, the officer may ask for more details. Once approved, you can download your GST certificate from the portal. In this way, you can complete your GST registration process India.

To Sum It Up

GST registration is essential for all new businesses that are planning to grow in India. Getting a GSTIN helps your business operate legally, follow GST rules and compliance, and collect and pay the correct taxes. With the clear steps and right documents, the online process becomes much simpler.

Whether you are running a shop, a small online store, or a service company, the GST registration allows you to do business smoothly and professionally. Now that you understand the full GST registration process in India, you can apply with confidence and stay ahead.